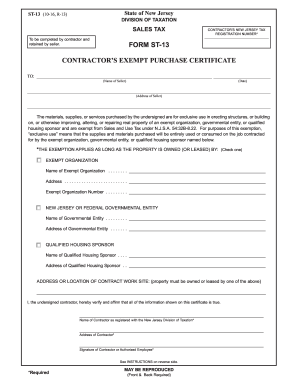

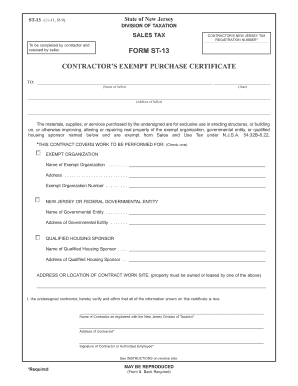

NJ ST-13 2024-2025 free printable template

Show details

ST13

(524)New Jersey Division of Taxation

Sales TaxContractors Exempt Purchase CertificateCheck applicable box:

SinglePurchase Certificate

Blanket CertificateThe seller must collect Sales Tax on the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 13 exempt certificate pdf form

Edit your st 13 contractor exempt purchase printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchase jersey new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit license jersey new online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax jersey form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ ST-13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 13 download form

How to fill out NJ ST-13

01

Obtain NJ ST-13 form from the New Jersey Division of Taxation website or request a paper form.

02

Fill out the taxpayer information section, including your name, address, and identification number.

03

Provide the description of the property for which you are claiming tax exemption.

04

Complete the claim for exemption portion, detailing the specific reasons for your exemption request.

05

Attach any required documentation that supports your claim, such as proof of ownership or related affidavits.

06

Review the form for accuracy and completeness before submission.

07

Submit the form by the prescribed deadline to the appropriate local tax assessor.

Who needs NJ ST-13?

01

Individuals or organizations that own property in New Jersey and are seeking tax exemptions based on specific qualifying criteria, such as charitable organizations, religious institutions, or government agencies.

Video instructions and help with filling out and completing nj form st 13 exempt fillable

Instructions and Help about nj form st 13 fillable

Fill

new jersey st 13 blank form

: Try Risk Free

People Also Ask about contractor's exempt purchase certificate

How to fill out a st-3 form nj?

How to Fill Out NJ Sales Tax Exempt Form ST-3? Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Provide your taxpayer registration number. Describe the nature of goods or services you sell in an ordinary course of business.

What is a NJ ST-3 form?

Form ST-3 Instructions Completing the Certificate. To claim an exemption from Sales Tax on the purchase of taxable property or services, the purchaser must provide a fully completed exemption cer- tificate to the seller. Otherwise, the seller must collect the tax.

What is the difference between St-3 and St 4 in NJ?

Some of the Resale Certificates you might use are: Form ST-3: Used for in-state suppliers. Form ST-3NR: Used for out-of-state suppliers. Form ST-4: Used for tax exemption on production machinery and packaging supplies.

What items are exempt from NJ sales tax?

The current Sales Tax rate is 6.625% and the specially designated Urban Enterprise Zones rate is one half the Sales Tax rate. Certain items are exempt from sales tax, such as food, clothing, drugs, and manufacturing/processing machinery and equipment. A resale exemption also exists.

How much is a seller's permit in NJ?

How much does it cost to apply for a sales tax permit in New Jersey? There is no fee required to file Form NJ-REG and register your business.

How do I become sales tax exempt in NJ?

Required Documentation A completed application (Form REG-1E) signed and dated by an officer, trustee, or responsible party; 2. Determination of Exempt Status. Submit the most recent copy of an IRS determination letter establishing exemption from certain federal taxes under an IRC 501(c) code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute new jersey st 13 online?

pdfFiller has made it easy to fill out and sign nj st 13 fillable form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in contractor exempt purchase certificate?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your nj st13 form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete new jersey form st 13 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your st 13 form nj. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NJ ST-13?

NJ ST-13 is a sales tax exemption certificate used in New Jersey, allowing certain organizations and individuals to make purchases exempt from sales tax.

Who is required to file NJ ST-13?

Organizations, such as non-profit entities, government agencies, and certain other exempt groups, are required to file NJ ST-13 to claim sales tax exemption.

How to fill out NJ ST-13?

To fill out NJ ST-13, provide the name and address of the purchaser, the seller's name, the reason for exemption, and the signature of an authorized representative.

What is the purpose of NJ ST-13?

The purpose of NJ ST-13 is to provide a standardized method for organizations to claim exemptions from sales tax on eligible purchases.

What information must be reported on NJ ST-13?

The information required on NJ ST-13 includes the purchaser's name and address, seller's name and address, type of exempt organization, reason for exemption, and the authorized signature.

Fill out your NJ ST-13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st13 is not the form you're looking for?Search for another form here.

Keywords relevant to form st 13

Related to st13 exempt

If you believe that this page should be taken down, please follow our DMCA take down process

here

.