NJ ST-13 2016-2024 free printable template

Show details

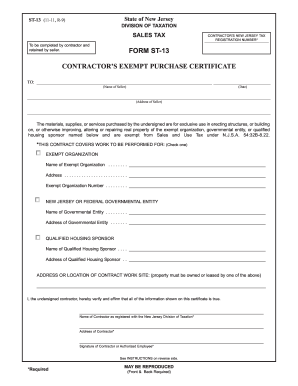

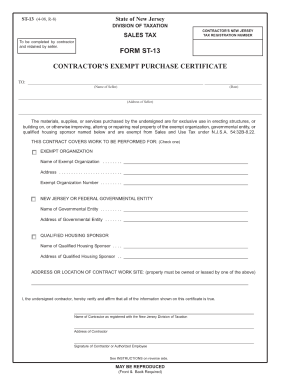

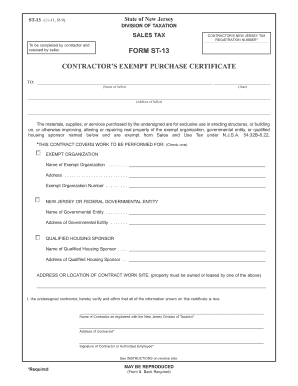

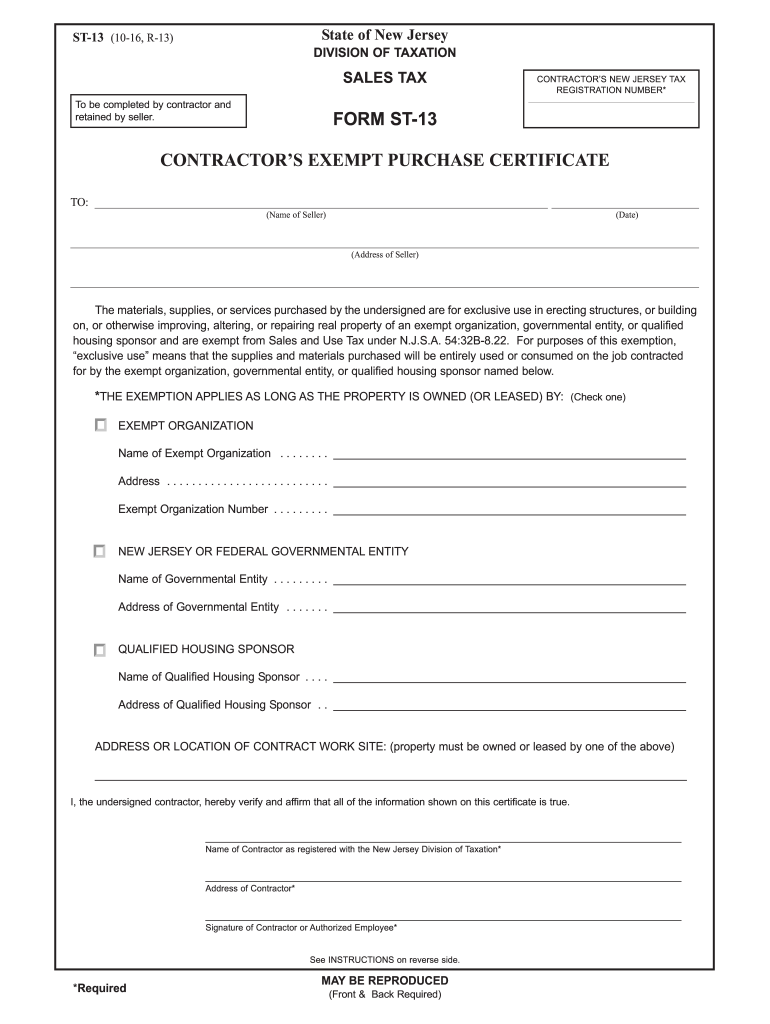

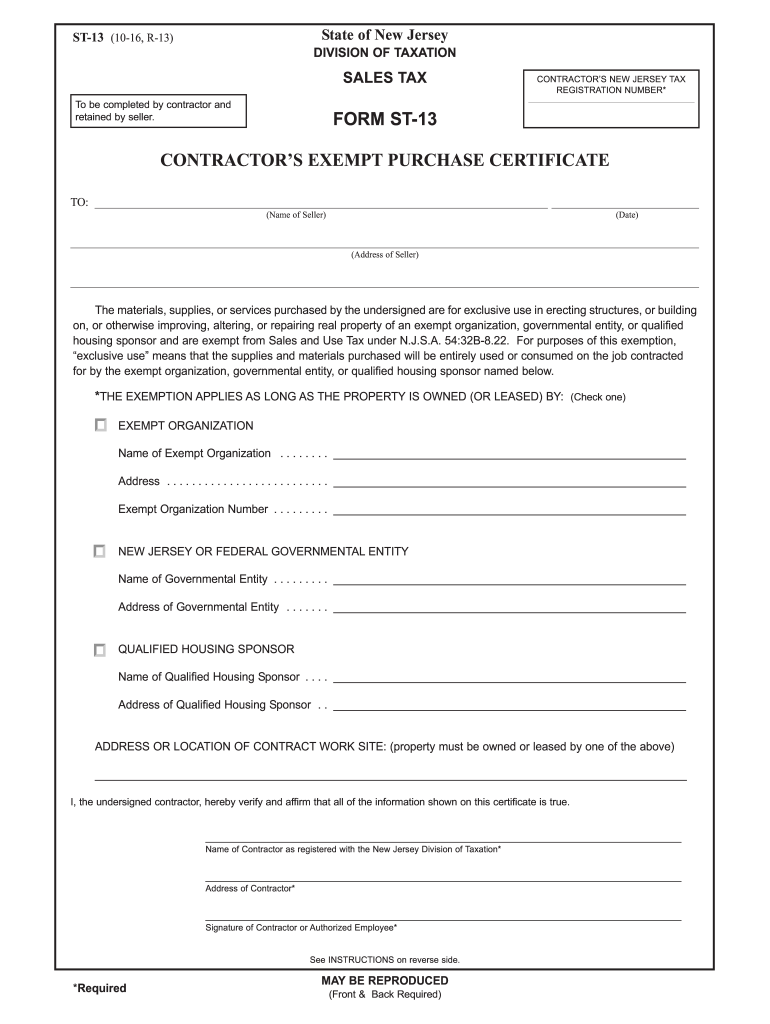

State of New Jersey ST-13 10-16 R-13 DIVISION OF TAXATION SALES TAX To be completed by contractor and retained by seller. CONTRACTOR S NEW JERSEY TAX REGISTRATION NUMBER FORM ST-13 CONTRACTOR S EXEMPT PURCHASE CERTIFICATE TO Name of Seller Date Address of Seller The materials supplies or services purchased by the undersigned are for exclusive use in erecting structures or building on or otherwise improving altering or repairing real property of an exempt organization governmental entity or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your st 13 form 2016-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 13 form 2016-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st 13 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit jersey new form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

NJ ST-13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 13 form 2016-2024

How to fill out New Jersey ST-13:

01

Ensure you have all the necessary information, such as your personal details, employer information, and income details.

02

Begin by filling out the top section of the form, which includes your name, social security number, and address.

03

Move to the next section, which requires you to provide your employer's name, address, and federal employer identification number (FEIN).

04

Fill out the income section, reporting your wages, tips, and other compensation.

05

If applicable, provide any additional income details, such as self-employment income or rental income.

06

Proceed to the deductions section, where you can claim deductions for federal taxes, social security tax, and Medicare tax.

07

Complete the credits section if you are eligible for any tax credits, such as the earned income credit or the child tax credit.

08

Review the form for any errors or missing information before signing and dating at the bottom.

09

Keep a copy of the filled-out form for your records.

Who needs New Jersey ST-13:

01

New Jersey residents who are employees and have to report their state income tax withholdings.

02

Employers in New Jersey who are required to withhold income taxes from their employees' wages.

03

Self-employed individuals in New Jersey who need to make estimated tax payments.

Video instructions and help with filling out and completing st 13 form

Instructions and Help about nj form st 13

Fill form st 13 : Try Risk Free

People Also Ask about st 13 form

How to fill out a st-3 form nj?

What is a NJ ST-3 form?

What is the difference between St-3 and St 4 in NJ?

What items are exempt from NJ sales tax?

How much is a seller's permit in NJ?

How do I become sales tax exempt in NJ?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new jersey st 13?

I couldn't find any specific information about "New Jersey St 13." Can you please provide more context or details?

Who is required to file new jersey st 13?

The State of New Jersey does not have a specific tax form called "st 13". Thus, there is no specific group of individuals or entities that are required to file this form. It is advisable to consult with a tax professional or the New Jersey Division of Taxation for specific filing requirements in the state.

How to fill out new jersey st 13?

To properly fill out the New Jersey ST-13 Form, follow these steps:

1. Obtain the form: Download the ST-13 Form from the official website of the New Jersey Division of Taxation or request a hard copy by contacting their office.

2. Identification section: Provide your business's name, address, identification number (Taxpayer Identification Number or Federal Employer Identification Number), and contact information.

3. Period covered: Indicate the month and year or specific time period the form pertains to.

4. Calculation of tax due: Calculate the taxable sales made during the period and multiply the total amount by the applicable sales tax rate. Enter this amount.

5. Calculating credits: If you have any sales tax credits, write down the total amount in the corresponding section. Common credits may include authorized tax deductions or exemptions.

6. Payment details: Sum up the tax due and the credits applied (subtract credits from tax due) to determine the final tax payable. Write this amount on the "Tax Due with Return" line.

7. Signature: Sign and date the form to certify its accuracy and completeness.

8. Submission: Make a copy of the completed form for your records, submit the original form, along with the appropriate payment (check, money order, or electronic payment if applicable), to the New Jersey Division of Taxation.

Note: It's recommended to consult the instructions provided by the New Jersey Division of Taxation for additional guidance and specific requirements related to your situation.

What is the purpose of new jersey st 13?

I couldn't find any specific information about "New Jersey St 13." It is possible that you may be referring to a specific section or statute of New Jersey law, or it could be a local street or address. Without more context or information, it is difficult to determine the purpose of New Jersey St 13.

How can I modify st 13 form without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like jersey new form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit st 13 online?

The editing procedure is simple with pdfFiller. Open your st 13 form nj in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the new jersey st 13 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your st 13 form 2016-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 13 is not the form you're looking for?Search for another form here.

Keywords relevant to st 13 purchase form

Related to new jersey form st 13

If you believe that this page should be taken down, please follow our DMCA take down process

here

.